The Ultimate Guide to Forex Trading Sessions in Kenyan Time (EAT): My Blueprint for Success

Picture this: It's 6:30 AM in Nairobi. The sun is just starting to peek over the Ngong Hills. You grab your cup of coffee, sit at your desk, and open your charts. You see that a massive move happened on GBP/JPY while you were asleep. You feel a pang of frustration. You missed it.

Later that day, around 2 PM, you enter a trade on EUR/USD. The market is absolutely dead. It moves sideways, barely budging, eating away at your patience. You ask yourself, "Why is nothing happening?"

If this sounds familiar, I want you to know one thing: You are not alone. I have been there. Every single trader in Kenya has felt this exact same frustration. The market feels random, chaotic, and unpredictable.

But what if I told you it isn't random?

What if I told you the market has a rhythm, a pulse, a daily schedule?

After more than a decade in the forex trading industry, I can tell you emphatically that it does.

The key to unlocking this rhythm is understanding the Forex Trading Sessions. And more importantly, understanding them in our own time zone – East Africa Time (EAT).

This isn't just textbook theory. This is the practical, on-the-ground knowledge that separates consistently profitable forex traders from those who are always one step behind.

So, grab that coffee, and let's talk.

Why The Forex Trading Sessions Are Everything

Before we get into the timings, you MUST understand why this matters.

Think of the forex market like a major city market – say, Marikiti or Gikomba.

At 4 AM, a few sellers are setting up. It's quiet. Not much business is happening. By 10 AM, the market is buzzing. It's packed with buyers and sellers. Prices are moving, deals are being made. This is a high-energy environment. By 9 PM, most stalls are closed. It's quiet again. A few stragglers might be around, but the main action is over.

The forex market works in the exact same way. It operates 24 hours a day, but the "energy" or liquidity and volatility comes from different financial centers around the world as they "open for business."

Trading during a high-energy session means:

- High Liquidity: Lots of buyers and sellers. You can get in and out of trades easily.

- Lower Spreads: The cost of trading (the spread) is usually tighter because of high volume.

- Big Moves: The market actually moves. This is where profit opportunities lie.

Trading when the market is "asleep" means you're stuck in that dead, sideways movement. It's a recipe for frustration and poor trading decisions. Your strategy isn't the problem; your timing is.

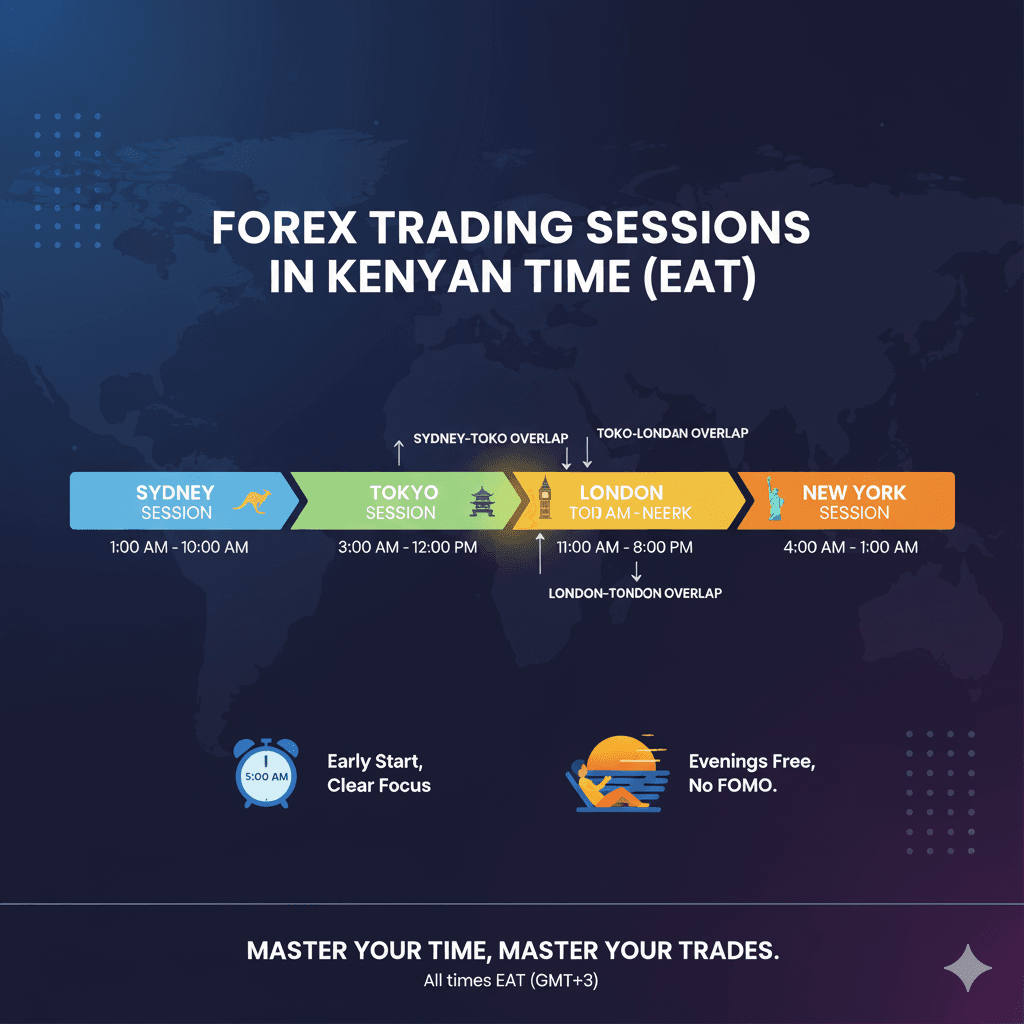

The Four Major Forex Sessions in Kenyan Time (EAT)

The global forex market is dominated by four key sessions. I've broken them down for you into our local time, EAT (which is GMT+3).

1. The Sydney Session (The "Opener")

- Open/Close in EAT: Approximately 12:00 AM (Midnight) - 9:00 AM EAT

- Personality: This is the quietest session. It's the official start of the trading day. Think of it as the market slowly stretching and waking up.

- Key Pairs: The Australian Dollar (AUD) and the New Zealand Dollar (NZD) see the most action. Think AUD/USD, NZD/USD, and their crosses.

- My Take for Kenyans: Honestly, most of us are asleep. Unless you're a night owl or a swing trader setting up long-term positions, you don't need to lose sleep over this one. It's a great session, however, to observe how the week might start to shape up.

2. The Tokyo Session (The "Asian King")

- Open/Close in EAT: Approximately 2:00 AM - 11:00 AM EAT

- Personality: The pace picks up. Tokyo is a massive financial hub. It’s more liquid than Sydney, but still generally calmer than the sessions that follow. The Japanese Yen (JPY) is the star of the show.

- Key Pairs: All JPY pairs (USD/JPY, EUR/JPY, GBP/JPY). AUD and NZD pairs are also still very active due to the time zone overlap.

- My Take for Kenyans: If you're an early riser, this session is for you. From 6 AM to 10 AM, you can catch the latter half of the Tokyo session. It often has clean, respectful trends, especially on JPY pairs. It's a fantastic time to analyze the markets before the London chaos begins.

3. The London Session (The "BEAST")

- Open/Close in EAT: Approximately 10:00 AM - 7:00 PM EAT (Note: This can shift by an hour due to Daylight Saving Time in Europe)

- Personality: This is the big one. London is the heart of global forex. When London opens, the market explodes with liquidity and volatility. It's a beast. It's aggressive. It's where the biggest moves of the day often happen.

- Key Pairs: All of them, but especially the majors. The British Pound (GBP) and the Euro (EUR) pairs are on fire. Think GBP/USD, EUR/USD, GBP/JPY.

- My Take for Kenyans: Your workday aligns almost perfectly with the most important session in the world. From your mid-morning coffee to when you're starting to think about leaving the office, you are in the prime trading zone. If you are a day trader or scalper in Kenya, the London session is your hunting ground.

4. The New York Session (The "Closer")

- Open/Close in EAT: Approximately 3:00 PM - 12:00 AM (Midnight) EAT

- Personality: The second giant awakens. The US market brings its own massive volume, driven by the US Dollar (USD), the world's reserve currency. The New York forex trading session is famous for major economic news releases like the Non-Farm Payroll (NFP).

- Key Pairs: All USD pairs are front and center. Majors like EUR/USD, GBP/USD, and USD/CAD are extremely active

My Take for Kenyans: This is where the magic truly happens, because this session overlaps with London. More on this in a moment. Your afternoon is the most potent time of the entire trading day.

The Golden Hours: The London-New York Overlap

If you learn nothing else from this article, learn this.

The most powerful, volatile, and opportunity-rich period of the entire 24-hour cycle is when the two biggest sessions overlap. This is the best time to trade almost any currency pair.

The London-New York Overlap: 3:00 PM - 7:00 PM EAT

This four-hour window is the Super Bowl of forex trading. You have the full force of London's financial might combined with the full force of New York's. The liquidity is astronomical. The volatility is at its peak.

This is when most major economic news from the US is released, causing massive spikes and trend-defining moves. For a day trader in Kenya, this is your prime time. Your entire day should be structured around being prepared, focused, and ready to execute during this window.

Forget trading at 1 PM when the market is dead. Forget trying to catch a small move at 1 AM. Focus your energy here. This is where the smart money trades.

My Personal Blueprint for a Kenyan Trader

So how do you put this all together? Here is a simple schedule I recommend to the traders I mentor:

- Early Morning (6 AM - 9 AM EAT): The Prep Phase.

- The Tokyo session is in full swing.

- Your Job: Don't trade yet. Analyze. What happened overnight? Review the charts, identify key support and resistance levels, read up on any major news, and formulate your trading plan for the day. Preparation is 80% of the battle.

- Mid-Morning (10 AM - 12 PM EAT): The London Open.

- The London session has awoken. Volatility surges.

- Your Job: Watch for the initial patterns. The opening hour can be wild and create false moves. Be patient. Look for your high-probability setups based on your pre-planned strategy. This is a great time to find your entry.

- Afternoon (3 PM - 7 PM EAT): THE MAIN EVENT.

- The London-New York Overlap. Maximum power.

- Your Job: Execute. This is where you should be laser-focused. This is the "golden hour" window. Manage your trades actively. This is often where you'll hit your daily target. Once you do, have the discipline to STOP.

- Evening (Post 7 PM EAT): The Cool-Down.

- London closes. The market's energy subsides a little, but the New York session is still active.

- Your Job: Manage any remaining trades. It's also the perfect time to review your performance for the day. What did you do well? Where did you make mistakes? Journal your trades. Plan for tomorrow.

Final Word: Trade Smarter, Not Harder

My friend, the forex market is open 24/5, but you should not be. Trying to trade all the time is the fastest way to burn out and blow your account.

Your goal is not to catch every single move. Your goal is to be present, prepared, and focused when the highest probability moves are likely to happen. By understanding the trading sessions from our unique Kenyan perspective, you are no longer guessing. You are aligning yourself with the natural rhythm of the market.

The market speaks a language of time. Learn to listen to it, and it will reward you.

Now go and look at your charts. Can you see the sessions? Can you see the shift in energy at 10 AM EAT? Can you see the explosion at 3 PM EAT? It's all there.