Tokyo Forex Trading Session in Kenyan Time

Session Overview

When it comes to forex trading sessions, one of the most common pieces of advice you'll hear is to focus on the busy London and New York sessions. While there's certainly money to be made there, I'm here to tell you about an overlooked opportunity, a strategic advantage that is perfectly suited to our lives here in Kenya: the Tokyo forex trading session.

Many dismiss it as "quiet" or "slow," but I see it differently. I see it as a professional's market—a time of clarity, predictability, and immense potential for the disciplined trader.

In this comprehensive guide, I will give you my complete blueprint for mastering the Tokyo forex trading session.

We will cover everything from the exact timings you need to know in East Africa Time (EAT) to the best currency pairs to trade, the specific strategies I use, and the forex brokers that offer the best conditions for us here in Kenya.

By the end of this, you will see the Asian market not as a secondary session, but as your potential trading powerhouse.

Decoding the Tokyo Session: A Kenyan Perspective

To succeed, you must first understand the environment you are trading in. The Tokyo session, also known as the Asian forex trading session, is more than just a time slot; it has a distinct personality and rhythm.

What is the Tokyo Trading Session?

The Tokyo session is the first major forex market to open for the week, kicking off the 24-hour trading cycle. It officially runs from midnight to 9:00 AM GMT.

Because it opens first, it often sets the initial tone and market sentiment for the rest of the trading day, which traders in London and New York will react to later.

While Tokyo is the main financial hub, this tforex rading period also sees significant activity from other major centres like Singapore, Hong Kong, and Sydney. This collective activity means the Asian session accounts for a substantial portion - around 20% - of all daily forex transactions.

The Japanese Yen (JPY) is the star of the show, being the third most-traded currency in the world and participating in nearly 17% of all forex trades.

The Only Clock You Need: Key Timings for Kenyan Traders (EAT)

Forget about converting from GMT or EST.

As a Kenyan trader, you need to operate on your own time. Our East Africa Time (EAT) is GMT+3, which gives us a unique and powerful advantage when it comes to trading the Asian markets.

The Tokyo session's official hours of 00:00 to 09:00 GMT translate directly to 3:00 AM to 12:00 PM EAT.

This timing is a game-changer for many Kenyans.

If you have a regular 9-to-5 job, you can wake up at 5 AM, analyse the markets, and place your trades before you even start your commute. You can be done with your trading day before your main workday even begins.

For full-time forex traders, this means you have a focused, calm morning session before the high-octane volatility of the London open kicks in. This is a far more balanced approach compared to the London/New York overlap, which runs from 4:00 PM to 8:00 PM EAT, a time when many of us are stuck in traffic or spending valuable time with our families.

The Tokyo session fits our lifestyle, allowing for a more sustainable and less stressful forex trading career.

To give you a complete picture of the 24-hour market cycle, here is a breakdown of all major sessions in Kenyan time.

| Session | Major Market | Opens (GMT) | Closes (GMT) | Opens (EAT) | Closes (EAT) |

| --- | --- | --- | --- | --- | --- |

| Sydney | Sydney | 22:00 | 7:00 | 1:00 AM | 10:00 AM |

| Tokyo | Tokyo | 0:00 | 9:00 | 3:00 AM | 12:00 PM |

| London | London | 8:00 | 17:00 | 11:00 AM | 8:00 PM |

| New York | New York | 13:00 | 22:00 | 4:00 PM | 1:00 AM |

Understanding the Overlaps: Where the Action Shifts

The moments when forex trading sessions overlap are critical because they bring together different groups of traders, increasing trading volume and liquidity. For the Tokyo session, two overlaps are particularly important.

- Sydney-Tokyo Overlap (3:00 AM - 10:00 AM EAT): This is a long and significant overlap. When both Sydney and Tokyo are open, liquidity is at its peak for Asia-Pacific currencies. This is the prime time to trade pairs involving the Australian Dollar (AUD), New Zealand Dollar (NZD), and Japanese Yen (JPY).

- Tokyo-London Overlap (11:00 AM - 12:00 PM EAT): This brief one-hour window is one of the most important moments of the trading day. As Asian traders are looking to close their positions, European traders are just starting their day. This flood of new liquidity from London often causes sharp price movements and breakouts from the ranges established during the quieter Asian hours.This is a period of high alert for breakout traders.

The Unique Rhythm of the Market: Liquidity and Volatility

The most defining characteristic of the Tokyo session is its relatively lower liquidity and volatility compared to the London and New York sessions.

Many beginner traders hear "low volatility" and think it means "no opportunity." This is a fundamental mistake.

In my experience, the chaos and extreme volatility of the London/New York overlap are where most new traders lose their accounts. The market moves so fast, driven by major news and institutional games, that it's easy to get caught in false moves and emotional decisions.

The Tokyo session offers what I call the "Quiet Advantage."

- Cleaner Price Action: Lower volatility means less market "noise." The price movements are often more measured and technical. This creates clearer, more defined, and more respected levels of support and resistance.

- Ideal Learning Environment: Because the price action is cleaner, this session is the perfect environment to practice and perfect your technical analysis skills. It rewards patience and precision.

- Strategic Opportunities: The calmness is a feature, not a flaw. It allows for specific strategies, like range trading, to work exceptionally well. It's a professional's environment that rewards a well-thought-out plan over impulsive reactions.

For the disciplined Kenyan trader, the Tokyo session provides a predictable and structured arena to execute high-probability trades without the extreme stress of the later sessions.

Your Watchlist: The Best Currency Pairs for the Tokyo Session

The Tokyo session is not a monolithic market; its personality changes depending on which currency pair you are watching.

I teach my students to think of it as a "two-speed" market, offering distinct opportunities for different trading styles.

Speed 1: The Movers and Shakers (High Volatility)

These are the currency pairs whose home markets are wide awake and active. They are directly influenced by the flow of economic data and capital within the Asia-Pacific region. If you are looking for directional moves and potential trends, these pairs should be on your primary watchlist.

- Focus Pairs: USD/JPY, AUD/JPY, NZD/JPY, EUR/JPY, GBP/JPY.

To trade them effectively, you must understand their fundamental drivers:

The Japanese Yen (JPY)

The JPY's value is heavily influenced by the monetary policy of the Bank of Japan (BoJ).

Key data releases to watch include their interest rate decisions, GDP figures, and the Tankan survey, a key measure of business confidence.

The JPY also has a unique "safe-haven" status; during times of global economic fear or instability, investors often buy the JPY, causing it to strengthen.

The Australian Dollar (AUD)

The AUD is a classic "commodity currency." Its value is strongly tied to the prices of Australia's major exports, particularly iron ore and coal.

The interest rate decisions of the Reserve Bank of Australia (RBA) are a major driver of volatility. Furthermore, because China is Australia's largest trading partner, any significant economic data coming from China can have an immediate impact on the AUD.

The New Zealand Dollar (NZD)

Similar to the AUD, the NZD is a commodity currency, but its value is more closely linked to agricultural exports, especially dairy products.

Policy decisions from the Reserve Bank of New Zealand (RBNZ) and overall global risk sentiment (how investors are feeling about the global economy) are critical factors to watch.

Speed 2: The Stable Consolidators (Low Volatility)

These are currency pairs whose home markets are closed. With the major banks and institutions in Europe and North America offline, there is a vacuum of major economic news and trading volume. This often causes these pairs to drift sideways in predictable patterns.

- Focus Pairs: EUR/USD, GBP/USD

For these pairs, the lack of activity is the opportunity itself. They tend to form clean, well-defined trading ranges.

This creates a perfect environment for range-bound strategies, where you can systematically buy at support and sell at resistance. It’s a methodical, patient style of trading that can yield consistent results.

Data-Driven Insights: What to Expect from Your Trades

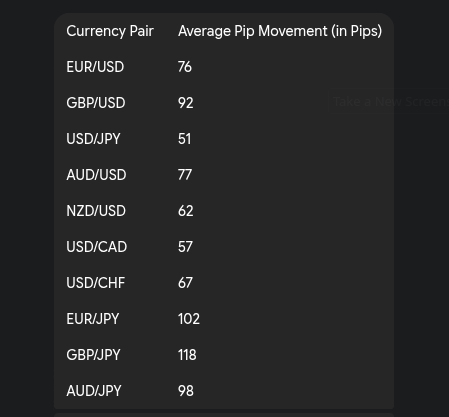

To set realistic profit targets and stop-losses, you need to know how much a currency pair typically moves.

This is measured in "pips."

A pip is the smallest price move a currency can make.

For most currency pairs, it's the fourth decimal place (e.g., if EUR/USD moves from 1.0750 to 1.0751, that is one pip). The major exception is for JPY pairs, where a pip is the second decimal place (e.g., if USD/JPY moves from 145.50 to 145.51, that is one pip).

The table below shows the average daily pip movement for major currency pairs specifically during the Tokyo session. This data is invaluable for planning your trades.

Notice the clear difference.

A pair like USD/JPY moves about 51 pips on average, making it a steadier instrument, while GBP/JPY moves more than double that at 118 pips, offering more volatility but also requiring wider stops. This data helps you choose the right pair for your chosen forex trading strategy and risk tolerance.

A final word on spreads: because liquidity is lower, spreads (the difference between the buy and sell price) can be wider during the Tokyo forex trading session compared to London.

However, if you choose a good forex broker with a Raw or ECN account, spreads on the most active pairs like USD/JPY and AUD/JPY can still be incredibly tight, often less than a pip.

Winning Strategies Tailored for the Tokyo Market

Theory is one thing, but practical application is what makes you money. Here are three powerful forex trading strategies that are perfectly suited to the unique characteristics of the Tokyo session.

Strategy 1: Mastering the Range-Bound Market (For the Consolidators)

This is my go-to strategy for pairs like EUR/USD and GBP/USD during the Tokyo session. It is simple, effective, and excellent for developing discipline. The core idea is to profit from the market's tendency to bounce between predictable horizontal levels.

Step-by-Step Execution:

- Identify the Range: On a 1-hour chart, look for at least two clear swing highs and two clear swing lows that occur at roughly the same price level. Draw horizontal lines to mark these levels. The top line is your resistance, and the bottom line is your support. The more times the price has touched and reversed from these levels, the more reliable the range is.

- Confirm with Oscillators: To avoid entering a trade too early, use an indicator like the Relative Strength Index (RSI) or the Stochastic Oscillator for confirmation. When the price approaches your resistance level, you want to see the RSI move into "overbought" territory (above 70). When it approaches support, you want to see the RSI in "oversold" territory (below 30). This confirms that momentum is exhausted and a reversal is likely.

- Entry: This is crucial: do not chase the price. Be patient and let the market come to your levels. Place a sell limit order a few pips below your resistance line and a buy limit order a few pips above your support line. This automates your entry and ensures you get a good price.

- Exit: Your plan for taking profit and cutting losses must be set in stone before you enter.

- Take-Profit: Set your take-profit target at the opposite boundary of the range. If you buy at support, your target is the resistance level.

- Stop-Loss: Place your stop-loss order just outside the range. For a buy trade at support, your stop-loss should be 15-20 pips below the support line. This protects you if the range breaks and a new trend begins.

Strategy 2: The Asian Range Breakout (For the Movers)

This strategy is designed for the more volatile pairs like AUD/JPY or GBP/JPY and specifically targets the Tokyo-London overlap. It is based on the idea that the consolidation during the Asian hours builds up pressure that is released when the London traders arrive, causing a strong directional move.

Step-by-Step Execution:

- Define the Asian Range: On your 1-hour chart, identify the highest high and the lowest low that occurred between roughly 3:00 AM and 10:00 AM EAT. Draw a box around this area. This is your "kill zone."

- Place Pending Orders: At about 10:30 AM EAT, just before the London open, you will set traps for the market. Place a buy-stop order 5-10 pips above the high of the Asian range and a sell-stop order 5-10 pips below the low of the range.

- Entry and Management: As the London volume pours in, the price will often spike in one direction, triggering one of your pending orders. The moment one order is filled, you must immediately cancel the other one.

- Exit:

- Stop-Loss: Your stop-loss for the trade is placed on the opposite side of the Asian range. If your buy-stop was triggered, your stop-loss goes just below the low of the range.

- Take-Profit: A simple and effective take-profit method is to measure the height of the Asian range in pips and project that distance 1.5 or 2 times from your entry point. For example, if the range was 40 pips high, you could set a take-profit target of 60 or 80 pips.

Strategy 3: Trading the News Like a Pro

The Tokyo session is when major economic data from the Asia-Pacific powerhouses is released. These events create predictable spikes in volatility and offer fantastic trading opportunities if you are prepared.

Key Economic Releases to Watch:

- Japan (JPY): Bank of Japan (BoJ) Policy Rate decisions, GDP data, and the Tankan Manufacturing Index are high-impact events.

- Australia (AUD): Reserve Bank of Australia (RBA) Rate Statement, Employment figures, Consumer Price Index (CPI), and Retail Sales data can move the AUD significantly.

- New Zealand (NZD): Reserve Bank of New Zealand (RBNZ) Rate Statement, GDP, CPI, and Employment data are the key drivers for the NZD.

How to Trade the News:

My advice is to never trade during the first few seconds of a news release. The spreads widen dramatically, and you are likely to experience severe slippage (getting filled at a much worse price than you intended). Instead, a professional approach is to wait.

- Stay Out: Do not have any open positions on the affected pair 15 minutes before the news release.

- Wait and Observe: Watch the market's reaction for the first 15-30 minutes after the data is released. Don't jump in on the initial spike.

- Identify the New Trend: After the initial chaos, a new short-term trend will often emerge. Look for a small pullback or consolidation.

- Enter on Confirmation: Enter a trade in the direction of the new, post-news trend. Place your stop-loss on the other side of the consolidation that formed just before the news release. This gives your trade a logical and protected place to be wrong.

Safeguarding Your Capital: Risk Management Essentials

Let me be very clear: you can have the best forex trading strategy in the world, but without disciplined risk management, you will fail. This is not optional; it is the foundation of your entire trading career.

My Golden Rule: The 1-2% Principle

This is the most important rule I can teach you. Never risk more than 1% to 2% of your total trading capital on a single trade.

If you have a $1,000 account, your maximum risk per trade should be $10 to $20. This principle ensures your survival. It means you could have a string of 10 losing trades in a row and still have most of your capital intact to fight another day.

It removes the emotion and desperation from trading and turns it into a professional business of probabilities.

Setting Smart Stop-Losses for Tokyo Session Strategies

A stop-loss is not an admission of failure; it is your insurance policy. It is the price at which you pre-determine your trade idea was wrong, and you exit with a small, manageable loss.

- For Range Trading: Your stop-loss must be placed logically outside the range. A common mistake is placing it right on the support or resistance line. It needs to be a bit further out to give the trade room to breathe and avoid being stopped out by minor "false breakouts" or "stop hunts".

- For Breakout Trading: The stop-loss is typically placed on the opposite side of the breakout range. Alternatively, you can use the Average True Range (ATR) indicator to set a stop that is based on the pair's recent volatility, which is a more dynamic approach.

Defining Your Risk-to-Reward Ratio (RRR)

The final piece of the puzzle is ensuring that your potential profits are significantly larger than your potential losses. I do not take any trade unless the potential reward is at least 1.5 times my risk (a 1:1.5 RRR), and I aim for 1:2 or higher.

Here's how it works:

- Risk: The distance in pips from your entry price to your stop-loss price.

- Reward: The distance in pips from your entry price to your take-profit price.

- Calculation: RRR=Reward/Risk

If you risk 30 pips to make a potential profit of 60 pips, your RRR is 2. This means that even if you only win 50% of your trades, you will still be very profitable over time. It is a mathematical edge that separates professional forex traders from gamblers.

The Kenyan Trader's Toolkit: Choosing the Right Forex Broker

Your broker is your business partner. Choosing the right one is critical, especially when trading the specific conditions of the Tokyo forex trading session. For us in Kenya, the criteria are clear and non-negotiable.

What Really Matters for a Kenyan Trader

- CMA Regulation: First and foremost, your broker MUST be regulated by the Capital Markets Authority (CMA) of Kenya. This is your single most important protection. It ensures your funds are segregated and provides you with legal recourse if something goes wrong. Do not compromise on this.

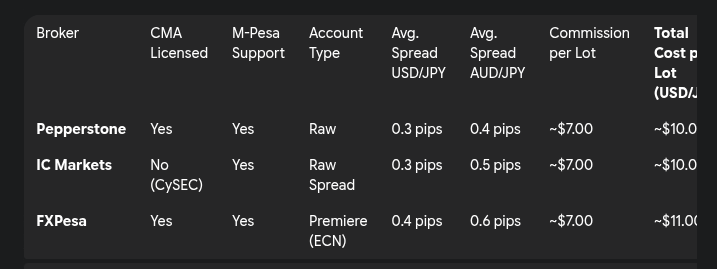

- Competitive Spreads on JPY & AUD Pairs: Since these are the pairs you'll likely be trading most, low transaction costs are essential. This means looking for a broker that offers a Raw Spread or ECN-style account, where spreads are razor-thin, and you pay a small, fixed commission.

- Fast and Reliable Execution: For breakout and news trading strategies, you need a broker with ultra-fast execution speeds to minimize slippage and ensure you get in and out of trades at the prices you want.

- Local Funding Methods: Convenience is key. Your broker must offer easy, fast, and low-cost deposit and withdrawal options. For Kenyans, this means M-Pesa support is a must-have.

My Top Broker Recommendations for Kenyans

Based on these strict criteria, a few forex brokers stand out for Kenyan traders looking to specialize in the Tokyo session.

It's important to understand that the "best" forex broker depends on your trading style.

A beginner might be attracted to a "zero commission" Standard account, but the wider spreads can be costly in the long run.

For serious, active trading, a Raw account is almost always more cost-effective. The total transaction cost, the spread plus the commission. is the true measure of a broker's pricing.

- Pepperstone: In my view, Pepperstone is a top-tier choice for serious Kenyan traders. They are regulated by the CMA (Licence No. 128), offer M-Pesa funding, and provide both Standard and Raw accounts on MT4, MT5, and cTrader. Their Raw account is particularly compelling for Tokyo session trading, with average spreads on USD/JPY around 0.3 pips and AUD/USD around 0.1 pips, plus a competitive commission.

- IC Markets: While their primary regulation is offshore, IC Markets is globally renowned for its excellent trading conditions, especially on their Raw Spread accounts. They offer extremely low spreads and are a favorite among scalpers and algorithmic traders. They also provide the cTrader platform, which many professional traders prefer.

- FXPesa: As a broker with a strong physical presence and focus on the East African market, FXPesa is a very accessible and reliable option. They are CMA-regulated and offer seamless M-Pesa integration. Their pricing and platform offerings make them a solid choice, particularly for those who value local support.

To make your decision easier, I have broken down the most important factor, the total cost of trading, for the most relevant pairs during the Tokyo session.

Spreads are indicative averages and can vary. Total cost is calculated as (Average Spread in pips * Pip Value) + Commission. Assumes a standard lot and USD/JPY pip value of ~$10.

This table cuts through the marketing and shows you the bottom line. For active trading on JPY pairs, a broker with a Raw account like Pepperstone or IC Markets offers a clear cost advantage over time.

Making the Tokyo Session Your Trading Powerhouse

We have covered a lot of ground. We have seen that the Tokyo forex trading session, far from being a sleepy backwater, is a market rich with strategic opportunities perfectly aligned with our lives here in Kenya.

Let's recap the Kenyan advantage:

- The Time is Right: The 3:00 AM to 12:00 PM EAT window fits seamlessly into our daily routines.

- The Quiet Advantage: Lower volatility means cleaner charts, more respected technical levels, and a perfect environment to build discipline and skill.

- The Two-Speed Market: It offers both trending opportunities in JPY and AUD pairs and clear ranging conditions in EUR and GBP pairs, catering to multiple trading styles.

- The Right Tools: We have access to world-class, CMA-regulated brokers with the low-cost accounts and M-Pesa funding we need to succeed.

Success in forex trading does not come from trading all the time; it comes from specializing, from becoming an expert in a specific market, a specific strategy, and a specific time of day.

The Tokyo forex trading session offers you a perfect arena to do just that. It rewards patience, planning, and precision, the very traits that define a professional trader.

My final piece of advice is this: take what you have learned here and apply it.

- Open a demo account with one of the brokers I've recommended.

- Wake up early, watch the JPY pairs, identify the ranges on EUR/USD, and practice the strategies.

- Build the discipline. The path to consistent profitability is a marathon, not a sprint, and mastering the Tokyo session could be the most important leg of your journey.

Trade with discipline, manage your risk, and I look forward to hearing about your success.

Session Times

Kenya Time (EAT)

03:00 a.m - 12:00 p.m

Local Time (GMT)

00:00 a.m - 09:00 a.m