London Forex Trading Session in Kenyan Time

Session Overview

I want to have a serious talk with you, trader to trader. let us s

Over my 10+ years in the forex market, I've seen countless Kenyan traders struggle. They have the passion, they have the drive, but they're missing one critical piece of the puzzle. They're showing up to the game at the wrong time.

Today, we fix that. We are going to master the single most important trading session in the world: the London session. Get this right, and I promise you, your entire perspective on trading will change.

Think of the 24-hour forex market like a grand music festival that runs all week.

- The Sydney session is the quiet opening act, setting the stage as the week begins.

- The Tokyo session is the supporting band, building up the energy and establishing an early rhythm.

But the London session? That's the headline act. It's when the stadium lights come on, the crowd roars, and the biggest hits are played. It's the institutional warm-up before the main U.S. act takes the stage.

And the London-New York overlap, which we'll get to, is the explosive encore everyone waits for.

As a trader, you want to be front and center for that main performance, not wandering around the food stalls when the real action is happening. Your job is to be ready when the curtain rises, and for us in Kenya, that curtain is the London session open.

Pinpointing the Exact London Session Time in Kenya

The Problem: Why Time Zones Trip Up 90% of New Traders

Listen closely, because this is where so many forex traders in Kenya get it wrong. Understanding time zones isn't a boring technicality; it's a foundational edge.

Here in Kenya, we are blessed with a stable East Africa Time (EAT), which is always GMT+3. We don't change our clocks. But this stability can create massive confusion when we're dealing with financial centers like London, which practices Daylight Saving Time (DST).

Getting this wrong means you're either an hour early or an hour late to the most important part of the trading day. Both are costly mistakes.

Demystifying the Jargon: GMT, UTC, and BST Explained for Kenyans

Let's clear this up once and for all. You'll see these acronyms everywhere, and they are simple.

- GMT (Greenwich Mean Time): This is the baseline, the "home time" for London during the winter months. It's the time zone the world historically set its clocks by.

- UTC (Coordinated Universal Time): This is the modern, scientific standard for time. For our purposes as forex traders in Kenya, you can think of UTC and GMT as the same thing. Most trading platforms and charts use UTC as their server time because it never changes.

- BST (British Summer Time): This is the crucial one you must understand. From the last Sunday in March to the last Sunday in October, the UK "springs forward" one hour to BST. During this period, London's time zone is GMT+1 (or UTC+1).This single change shifts the entire market landscape for us in Kenya.

The "Aha!" Moment: Translating to East Africa Time (EAT)

So, what does this mean for your trading desk in Nairobi, Mombasa, or Kisumu? The math is simple, but vital.

- During the UK Winter (when London is on GMT), they are 3 hours behind our EAT (GMT+3).

- During the UK Summer (when London is on BST), they are only 2 hours behind our EAT (GMT+3).

The standard London session runs from 8:00 AM to 5:00 PM local time, though some sources may vary slightly.

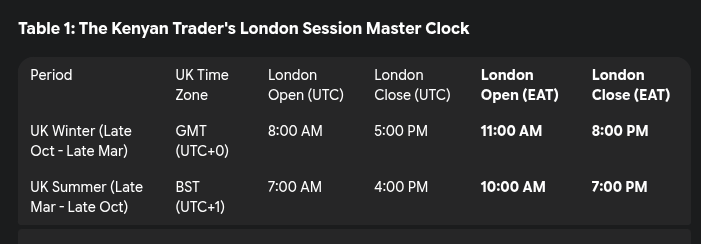

During the summer, this shifts to 7:00 AM to 4:00 PM UTC to account for DST. This brings us to the most important table in this entire guide. Print it out. Stick it on your wall. This is your master clock.

Period | UK Time Zone | London Open (UTC) | London Close (UTC) | London Open (EAT) | London Close (EAT) |

UK Winter (Late Oct - Late Mar) | GMT (UTC+0) | 8:00 AM | 5:00 PM | 11:00 AM | 8:00 PM |

UK Summer (Late Mar - Late Oct) | BST (UTC+1) | 7:00 AM | 4:00 PM | 10:00 AM | 7:00 PM |

Note: The UK switches to BST on the last Sunday of March and back to GMT on the last Sunday of October each year. For 2025, this change happens on March 30 and October 26.

Being aware of this simple calendar adjustment places you in a more professional, prepared category than the masses who don't bother. Showing up at 11:00 AM EAT in April, thinking the London session is just opening, is a classic rookie mistake. The market has already been active for an hour, the initial moves have happened, and you're left chasing the price.

By knowing the correct time, you are mentally and strategically prepared for the session's true opening bell, ready to capitalize on the initial volatility rather than becoming a victim of it.

Why They Call London the "King of Sessions": Understanding the Engine Room of Forex

The Heart of the Market

It's critical to understand that the London session isn't just another time slot; it's the geographical and historical heart of the foreign exchange market.

The numbers are staggering: London alone accounts for approximately 43% of all global forex transactions. That makes it the largest and most important single forex center in the world, dwarfing New York and Tokyo. This isn't just a piece of trivia; it's the fundamental reason for the session's unique and powerful characteristics.

The Three Pillars of the London Session

Everything that makes this session a goldmine for traders rests on three interconnected pillars.

- Unparalleled Liquidity: In simple terms, liquidity is the ease with which you can buy or sell a currency without causing a massive price swing. During the London session, all the major global banks, hedge funds, and financial institutions are at their desks, moving colossal sums of money. This creates the highest liquidity of any session. For you, the Kenyan trader, this translates directly into tangible benefits: tighter spreads (meaning lower transaction costs), reduced slippage on your orders, and the confidence that your trades will be executed efficiently at the price you want.

- Massive Trading Volume: Volume is the total amount of currency being traded. The immense liquidity in London is driven by incredible trading volume. Why does this matter? Because volume validates price moves. A price breakout that occurs on high volume is a powerful signal that the "big money" is behind the move, making it far more reliable. A move on low volume, however, is suspect and more likely to be a false signal. During the London session, you have the volume you need to trade with conviction.

- High Volatility: Volatility is the lifeblood of a trader. It's the degree of price movement, and without it, we can't make money. The London session is famous for its volatility, which is a natural result of its high liquidity and volume. In fact, the London session consistently shows the highest average pip movement for major currency pairs compared to any other single session. This means more opportunities, clearer trends, and more decisive price swings for you to profit from.

The London open is more than just a time on the clock; it's a major market event. It represents the first reaction from institutional players to all the news and price action that occurred during the quieter Asian session.

The first one to two hours of London trading is essentially the "smart money" revealing its hand for the day:

- Are they aggressively buying and pushing prices above the Asian session highs?

- Or are they selling heavily, confirming a bearish sentiment?

By observing this initial activity, you learn to read the "story" of the trading day. The London open writes Chapter 1, establishing the plot and the main characters (the bulls or the bears). The rest of the day, including the New York session, often follows this initial narrative.

The Golden Hours: Mastering the Tokyo-London and London-New York Overlaps

Why Overlaps are a Trader's Best Friend

If the London session is the main event, then the session overlaps are the moments of peak excitement.

When two major financial centers are open simultaneously, the market is flooded with participants. This causes a surge in volume, a spike in liquidity, and a blast of volatility. These are the golden hours, the absolute best times to be at your charts.

The Tokyo-London Handover (10:00 AM - 11:00 AM EAT)

This is a brief but crucial one-hour window where Asian traders are closing their day just as European traders are beginning theirs.

- Characteristics: While not as explosive as the later overlap, this period is highly significant. It's often when the initial trend for the day is set. Because the Asian session is typically quiet and range-bound, the influx of London volume frequently causes a decisive breakout of that established range.

- Best Pairs to Watch: This is the prime time to watch JPY crosses. With both European and Japanese markets active, pairs like EUR/JPY and GBP/JPY see a dramatic increase in activity and provide excellent opportunities.

The Power Overlap: London-New York (4:00 PM - 8:00 PM EAT)

Mark these hours. This is the absolute climax of the trading day. For any day trader in Kenya, this four-hour window is the most important period to master. It's perfectly timed for those coming home from a day job, offering a gateway to the market's most potent phase.

- Characteristics: This is, without question, the most liquid and volatile period of the entire 24-hour cycle. The world's two largest financial centers, London and New York, are fully operational, together accounting for over 50% of all daily forex trades. Furthermore, high-impact economic news from the United States (like inflation or employment data) is often released during this window, adding even more fuel to the fire.

- Best Pairs to Watch: All major pairs become electric. EUR/USD, GBP/USD, USD/CHF, and USD/CAD are particularly active. Even Gold (XAU/USD) sees significant movement. The average pip range for these pairs can explode during this overlap, offering tremendous opportunity.

The dynamic of the London-New York overlap is fascinating. On one hand, you have European institutions closing their positions for the day-taking profits or cutting losses- while North American traders are just starting, reacting to their own data and analysis.

This creates a massive transfer of liquidity and often a fierce battle for directional control. This is the "volatility crucible." And for us in Kenya, this crucible happens from 4:00 PM to 8:00 PM EAT. This is a massive lifestyle advantage.

You don't need to wake up at 3:00 AM. You can work a full-time job and still be present for the most powerful and opportunity-rich part of the trading day. This isn't just a time slot; it's a strategic gift that should be the cornerstone of your trading plan.

Overlap | Time (EAT) | Key Characteristics | Best Pairs to Watch |

Tokyo-London | 10:00 AM - 11:00 AM | Moderate volatility, potential for Asian range breakouts, sets the day's initial trend. | EUR/JPY, GBP/JPY, AUD/JPY |

London-New York | 4:00 PM - 8:00 PM | Peak volatility and liquidity, major news releases, strong directional moves. | EUR/USD, GBP/USD, USD/JPY, XAU/USD (Gold) |

Your Arsenal: Proven Strategies for Conquering the London Session

A professional trader knows you can't use a hammer for every job. The London session has distinct phases, and each requires the right strategy. Here are three powerful approaches tailored for this dynamic environment.

Strategy 1: The London Breakout (The "Opening Bell" Play)

This is a classic strategy that aims to profit from the surge in volatility as the London session begins. The core idea is simple: the quiet, range-bound Asian session creates clear support and resistance levels. When the flood of institutional volume from London hits the market, the price is likely to break out of this range decisively.

- Step 1: Define the Range. On your chart, identify the highest high and lowest low of the last 3-4 hours of the Asian session (this is roughly from 6:00 AM to 10:00 AM EAT). Draw horizontal lines at these two points. This is your "kill zone."

- Step 2: Place Pending Orders. Set a buy stop order a few pips above the high of the range and a sell stop order a few pips below the low of the range.

- Step 3: Wait for the Breakout. As the London session opens (10:00 AM or 11:00 AM EAT, depending on the season), the increased volume will often trigger one of your pending orders.

- Step 4: Manage the Trade. Once one order is triggered, immediately cancel the other. Place your stop-loss on the opposite side of the range. For example, if your buy stop is triggered, your stop-loss goes just below the range's low. Set your take-profit target based on a positive risk-reward ratio, such as 1:2 or 1:3.

Strategy 2: Trend Following (Riding the "London Bus")

The London session is famous for creating strong, clear trends that can last for hours. This strategy isn't about catching the very first move; it's about identifying the established direction and joining the ride. Think of it as waiting for the bus to start moving and then hopping on at the next stop, rather than trying to jump on while it's accelerating from a standstill.

- Step 1: Identify the Trend. After the initial hour of the London open, use technical indicators like the 50-period and 200-period Exponential Moving Averages (EMAs) on a 15-minute or 1-hour chart. If the price is consistently above both EMAs and they are angled up, the trend is bullish. If the price is below and they are angled down, the trend is bearish.

- Step 2: Wait for a Pullback. This is crucial. Never chase the price when it's extended. Be patient and wait for the price to pull back to a level of value, such as a retest of the 21 or 50 EMA, or a previous support/resistance zone.

- Step 3: Look for Entry Confirmation. Your entry trigger is a candlestick pattern that confirms the pullback is over and the trend is resuming. Look for a bullish pin bar or engulfing candle at your support level in an uptrend, or a bearish version at resistance in a downtrend.

- Step 4: Manage the Trade. Place your stop-loss just below the low of the pullback for a long trade, or just above the high for a short trade. You can target the next major support/resistance level or use a trailing stop-loss to ride the trend for as long as possible.

Strategy 3: Smart Money Concepts (SMC) (Thinking Like the "Big Boys")

The Smart Money Concepts is a more advanced strategy, but it's incredibly powerful in the London session because this session is driven by institutional order flow. SMC focuses on identifying where the large banks are likely to manipulate the market to acquire their large positions before initiating the real move.

- Step 1: Identify Liquidity. Mark the high and low of the Asian session. These levels are magnets for price because they represent "liquidity pools" where retail traders have placed their stop-loss orders.

- Step 2: Watch for the "Sweep." At the London open, watch for an aggressive price push that breaks above the Asian high or below the Asian low, only to quickly and sharply reverse. This is a "liquidity sweep" or "stop hunt." The smart money has just taken out the stops and tricked traders into thinking a breakout is occurring.

- Step 3: Look for a Market Structure Shift (MSS). After the sweep, the key confirmation is a break of market structure. If the price swept the high and then broke below the most recent swing low, that's a bearish MSS, signaling that sellers are now in control. The opposite is true for a sweep of the low.

- Step 4: Enter on the Fair Value Gap (FVG). The powerful, impulsive move that creates the MSS often leaves behind an inefficient price candle, known as a Fair Value Gap. This is a three-candle formation where there is a gap between the first candle's high and the third candle's low (or vice-versa). Mark this gap and place a limit order inside it, anticipating that the price will return to "rebalance" this inefficiency before continuing in the new direction.

News Trading During the London Session

Trading directly on a news release is like trying to catch a falling knife. It is extremely risky and not recommended for beginners. However, being aware of scheduled news is non-negotiable. Use a reliable economic calendar from sources like Forex.com, IG, Myfxbook, or Dukascopy to stay informed.

Table 3: Key Economic Releases to Watch During the London Session (EAT)

Economic Indicator | Releasing Body | Usual Release Time (EAT) | Potential Impact on EUR & GBP |

Consumer Price Index (CPI) | ONS (UK), Eurostat (EU) | 10:00 AM / 1:00 PM | High - Affects inflation and interest rate policy. |

Gross Domestic Product (GDP) | ONS (UK), Eurostat (EU) | 10:00 AM / 1:00 PM | High - Measures economic health. |

Bank of England (BoE) Rate Decision | Bank of England | 3:00 PM | Very High - Direct impact on GBP. |

European Central Bank (ECB) Rate Decision | European Central Bank | 3:45 PM | Very High - Direct impact on EUR. |

Retail Sales | ONS (UK), Destatis (DE) | 10:00 AM | Medium-High - Indicates consumer spending. |

The Trader's Daily Blueprint: A Routine for the Kenyan Trader

The Power of Routine

Let me be very clear: professional forex trading is not about constant excitement and gambling. It is about disciplined, repeatable processes. A consistent daily routine is the bedrock of success. It removes emotion, reduces decision fatigue, and turns trading from a hobby into a business.

A Step-by-Step Daily Plan

- Phase 1: Pre-Market Prep (9:00 AM - 10:00 AM EAT)

- Review Overnight Markets: See what happened during the Asian session. Note the high and low to prepare for potential breakout strategies.

- Check the Economic Calendar: Identify any "red folder" high-impact news for the day. Mark these times on your charts so you are not caught by surprise.

- Top-Down Analysis: Start with the Daily and 4-Hour charts. What is the overall market direction? Mark the key weekly and daily support and resistance levels. Your trades should align with this higher timeframe bias.

- Formulate a Plan: Based on your analysis, decide which strategy you will look for today. Are conditions right for a breakout? Is there a clear trend to follow? Write down your plan: "Today, I am looking for a bullish trend continuation on GBP/USD if it pulls back to the 1-hour 50 EMA".

- Phase 2: Active Trading Window (10:00 AM - 8:00 PM EAT)

- London Open (10:00/11:00 AM): Be at your desk, focused, and ready to execute the plan you just made. This is where the initial volatility kicks in.

- Mid-Session Lull (1:00 PM - 3:00 PM): Activity often quiets down as London traders go for lunch. This is an excellent time for you to take a break, have a meal, and step away from the screen to avoid forcing low-quality trades.

- The Power Overlap (4:00 PM - 8:00 PM): This is prime time. Your focus should be at its peak. Execute your plan with discipline and precision.

- Phase 3: Post-Market Review (After 8:00 PM EAT)

- Journal Everything: This is non-negotiable. Log every trade you took. Record your entry price, exit price, stop-loss, the reason for the trade, and your emotional state. A detailed journal is the ultimate tool for improvement.

- Review and Reflect: What did you do well today? Where did you deviate from your trading plan? What lessons can you learn from your wins and your losses?

- Shut Down: When you are done, shut down your trading platform. Step away from the charts. Rest and recovery are critical parts of a professional routine. Do not sit there all night watching every tick.

Table 4: Sample Daily Schedules for Kenyan Traders

Time (EAT) | Full-Time Trader Activity | Part-Time Trader Activity (with Day Job) |

9:00 AM | Pre-Market Analysis, News Check, Plan Formulation | Quick Market Check on Phone, Set Price Alerts |

10:00 AM - 1:00 PM | Active Trading, Executing London Open Strategies | Focus on Day Job, Monitor Alerts on Phone |

1:00 PM - 3:00 PM | Lunch Break, Mid-Session Analysis | Lunch Break, Quick Chart Review |

4:00 PM - 8:00 PM | Peak Focus: Trading the London-NY Overlap | Primary Trading Window: Come Home, Execute Plan |

After 8:00 PM | Journaling, Review, Prepare for Next Day | Journaling, Review, Prepare for Next Day |

Risk Management: The Thread That Holds It All Together

No strategy or routine will save you without iron-clad risk management. This is the foundation upon which your entire forex trading career is built.

- The 1% Rule: Never, ever risk more than 1% of your total trading capital on a single trade.

- Use Stop-Losses: Every single trade you place must have a pre-defined stop-loss order. This is your safety net. Trading without one is professional suicide.

- Seek Positive Risk-Reward: Only take trades where your potential profit (take-profit) is at least twice as large as your potential loss (stop-loss). A 1:2 risk-to-reward ratio is a minimum for long-term profitability.

Your Journey Starts Now

I've given you the map. I've shown you the path that I and other professional traders walk every single day. But you are the one who has to take the steps.

We've covered everything: the exact times the London session opens and closes in Kenya, why it's the king of all forex trading sessions, how to harness the power of the overlaps, and the specific strategies you can use to attack the market. We've even laid out a daily routine that fits your life, whether you trade full-time or after your day job.

The London session isn't just a time slot on a chart; it's a daily appointment with opportunity. Be prepared for it. Be disciplined during it. And be reflective after it. Do this consistently, and you won't just be a trader clicking buttons; you'll become a professional who operates a business.

Now, go and conquer those markets. I'll be watching.

Trading Tips

Trade sober.

Session Times

Kenya Time (EAT)

10:00 a.m - 7:00 p.m

Local Time (GMT)

8:00 a.m - 5:00 p.m

Major Currency Pairs

| Pair | Avg Spread |

|---|---|

| EURUSD | 0.1 pips |

| GBPUSD | 0.2 pips |

Key Characteristics

- Highest liquidity (43%)

- High volatility

- Sets the mood and trend of the day